And some may insist that the under-applied overhead be allocated among cost of goods sold and ending inventories–which would defeat the purpose of basing the predetermined overhead rate on capacity. The predetermined overhead rate formula can be used to balance expenses with production costs and sales. For businesses in manufacturing, establishing and monitoring an overhead rate can help keep expenses proportional to production volumes and sales. It can help manufacturers know when to review their spending more closely, in order to protect their business’s profit margins.

- The best way to predict your overhead costs is to track these costs on a monthly basis.

- This allocation can come in the form of the traditional overhead allocation method or activity-based costing..

- The estimate will be made at the beginning of an accounting period, before any work has actually taken place.

- The overhead rate for the packaging department is calculated by taking the estimated manufacturing overhead cost and dividing it by the estimated direct labor cost.

- As a result, the overhead costs that will be incurred in the actual production process will differ from this estimate.

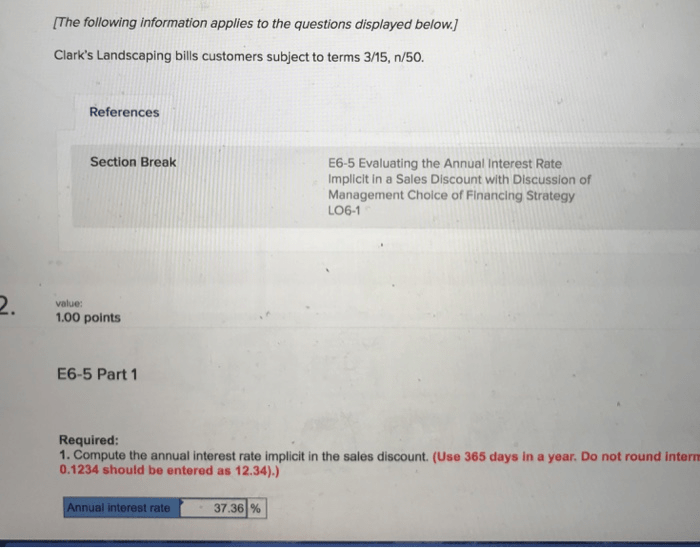

This project is going to be lucrative for both companies but after going over the terms and conditions of the bidding, it is stated that the bid would be based on the overhead rate. This means that since the project would involve more overheads, the company with the lower overhead rate shall be awarded the auction winner. Therefore, this predetermined overhead rate of 250 is used in the pricing of the new product. The elimination of difference between applied overhead and actual overhead is known as “disposition of over or under-applied overhead”. For example, if ABC Manufacturing’s actual manufacturing overhead was $100,000 but their applied manufacturing overhead was only $60,000, they underapplied $40,000. Conversely, if the actual manufacturing overhead was $100,000 but their applied manufacturing overhead was $120,000, they overapplied by $20,000.

AccountingTools

On your current project (coded as J-17), your division has spent $2,600 on direct materials; therefore, the predetermined overhead for this project will be $4,550 ($2,600 times 175%). The actual amount of total overhead will likely be different by some degree, but your job is to provide the best estimate for each project by using the predetermined overhead rate that you just computed. There are a number of factors that go into calculating a predetermined overhead rate. These include the estimated amount of overhead costs for the period, as well as an estimation of the amount of production during that same period.

For example, the costs of heating and cooling a factory in Illinois will be highest in the winter and summer months and lowest in the spring and fall. If the overhead rate is recomputed at the end of each month or each quarter based on actual costs and activity, the overhead rate would go up in the winter and summer and down in the spring and fall. As a result, two identical jobs, one completed in the winter and one completed in the spring, would be assigned different manufacturing overhead costs.

This information is then used to calculate an overhead rate per unit of production. This is related to an activity rate which is a similar calculation used in Activity-based costing. A pre-determined overhead rate is normally the term when using a single, plant-wide base to calculate and apply overhead. Overhead is then applied by multiplying the pre-determined overhead rate by the actual driver units. Any difference between applied overhead and the amount of overhead actually incurred is called over- or under-applied overhead. For example, the recipe for shea butter has easily identifiable quantities of shea nuts and other ingredients.

Predetermined Overhead Rate: Explanation

This is calculated at the start of the accounting period and applied to production to facilitate determining a standard cost for a product. Commonly used allocation bases are direct labor hours, direct labor dollars, machine hours, and direct materials cost incurred by the process. The predetermined overhead rate is set at the beginning of the year and is calculated as the estimated (budgeted) overhead costs for the year divided by the estimated (budgeted) level of activity for the year. This activity base is often direct labor hours, direct labor costs, or machine hours. Once a company determines the overhead rate, it determines the overhead rate per unit and adds the overhead per unit cost to the direct material and direct labor costs for the product to find the total cost.

If overhead is underestimated, then the company may set their prices too low and not earn profits or experience a loss. Second, if the underlying assumptions change (e.g., the expected level of activity), the rates will no longer be accurate and will need to be recalculated. Finally, predetermined overhead rates can be difficult to update on a regular basis, which can lead to outdated information being used in decision-making. By understanding how to calculate this rate, business owners can better control their overhead costs and make more informed pricing decisions. Predetermined overhead rates are important because they provide a way to allocate overhead costs to products or services.

- Since the numerator and denominator of the POHR formula are comprised of estimates, there is a possibility that the result will not be close to the actual overhead rate.

- In production, the predetermined overhead rate is computed to facilitate the determination of the standard cost for a product.

- And some may insist that the under-applied overhead be allocated among cost of goods sold and ending inventories–which would defeat the purpose of basing the predetermined overhead rate on capacity.

- Monitoring a well-defined rate provides a quick signal that lets you know when it’s time to review spending and, in doing so, will help you protect your profit margins.

- The predetermined overhead rate is the estimated cost of manufacturing a product.

Overhead is the name given to those expenses that are not directly related to any specific task or job. Examples of overhead costs include rent, utilities, office supplies, and administrative salaries. The concept of predetermined overhead rate is very important because it is used most of the enterprises as it enables them to estimate the approximate total cost of each job. Larger organizations employ different allocation bases for determining the predetermined overhead rate in each production department. However, in recent years the manufacturing operations have started to use machine hours more predominantly as the allocation base. Enter the total manufacturing overhead cost and the estimated units of the allocation base for the period to determine the overhead rate.

Predetermined overhead rate definition

With 150,000 units, the direct material cost is $525,000; the direct labor cost is $1,500,000; and the manufacturing overhead applied is $750,000 for a total Cost of Goods Sold of $2,775,000. The overhead rate for the packaging department is calculated by taking the estimated manufacturing overhead cost and dividing it by the estimated direct labor cost. In simple terms, it’s a kind of allocation rate that is used for estimated costs of manufacturing over a given period. It’s a good way to close your books quickly, since you don’t have to compile actual manufacturing overhead costs when you get to the end of the period. Keep reading to learn about how to find the predetermined overhead rate and what this means.

The predetermined overhead rate computed above is known as single or plant-wide overhead rate which is mostly used by small companies. In large ones, each production department computes its own rate to apply overhead cost. The use of multiple predetermined overhead rates may be a complex and time consuming task but is considered a more accurate approach than applying only a single plant-wide rate. Overhead costs are then allocated to production according to the use of that activity, such as the number of machine setups needed. In contrast, the traditional allocation method commonly uses cost drivers, such as direct labor or machine hours, as the single activity. A predetermined overhead rate is defined as the ratio of manufacturing overhead costs to the total units of allocation.

Predetermined Overhead Rate

This option is best if you’re unsure of how to calculate your predetermined overhead rate or if you don’t have the time to do it yourself. Again, this predetermined overhead rate can also be used to help the business owner estimate their margin on a product. Then, they’ll need to estimate the amount of activity or work that will be performed in that same time period. For this example, we’ll say the marketing agency estimates that it will work 2,500 hours in the upcoming year. Here’s how a service-based business, namely a marketing agency, might go about calculating its predetermined overhead rate.

If the predetermined overhead rate calculated is nowhere close to being accurate, the decisions based on this rate will definitely be inaccurate, too. That is, if the predetermined overhead rate turns out to be inaccurate and the sales and production decisions are made based on this rate, then the decisions will be faulty. When there is a big difference between the actual and estimated overheads, unexpected expenses will definitely be incurred. Also, profits will be affected when sales and production decisions are based on an inaccurate overhead rate. Managers and accounting personnel should work together to analyze the historical overhead information to look for relationships between the total overhead and one of the specific allocation bases.

A pre-determined overhead rate is the rate used to apply manufacturing overhead to work-in-process inventory. The first step is to estimate the amount of the activity base that will be required to support operations in the upcoming period. The second step is to estimate the total manufacturing cost at that level of activity. The third step is to compute the predetermined overhead rate by dividing the estimated total manufacturing overhead costs by the estimated total amount of cost driver or activity base. Common activity bases used in the calculation include direct labor costs, direct labor hours, or machine hours.

Calculating Predetermined Overhead Rate

The rate is determined by dividing the fixed overhead cost by the estimated number of direct labor hours. Predetermined overhead rate can be a useful tool for businesses that need to accurately budget their production costs. It involves estimating the total cost of producing goods and services, then dividing it by either direct labor hours or machine hours used in production. Knowing your predetermined overhead rate helps you plan and control future expenditures effectively, improving efficiency and profitability for your business. With this information in mind, it pays to take some time to calculate your own predetermined overhead rate so that you can manage expenses with confidence.

Calculating the Overhead Rate: A Step-by-Step Guide – The Motley Fool

Calculating the Overhead Rate: A Step-by-Step Guide.

Posted: Wed, 18 May 2022 17:00:08 GMT [source]

When the Predetermined overhead rate is not exactly what the company estimated, the rate would be either overapplied or underapplied. Overhead rate is a percentage used to calculate an estimate for overhead costs on projects that have not yet started. It involves taking a cost that is known (such as the cost of materials) and then applying a percentage (the predetermined overhead rate) to it in order to estimate a cost that is not known (the overhead amount). Cost accountants want to be able to estimate and allocate overhead costs like rent, utilities, and property taxes to the production processes that use these expenses indirectly. Since they can’t just arbitrarily calculate these costs, they must use a rate. In order to find the overhead rate we will use the same basis that we have chosen by multiplying this basis by the calculated rate.

Because of this decrease in reliance on labor and/or changes in the types of production complexity and methods, the traditional method of overhead allocation becomes less effective in certain production environments. To account for these changes in technology and production, many organizations today have adopted an overhead allocation method known as activity-based costing (ABC). This chapter will explain the transition to ABC and provide a foundation in its mechanics.

Using the planned annual amounts for the upcoming year reduces the fluctuations that would occur if monthly rates were used. That amount is added to the cost of the job, and the amount in the manufacturing overhead account is reduced by the same amount. At the end of the year, the amount of overhead estimated and applied should be close, although it is rare for the applied amount to exactly equal the actual overhead.

Examples of manufacturing overhead costs include indirect materials, indirect labor, manufacturing utilities, and manufacturing equipment depreciation. Another way to view it is overhead costs are those production costs that are not categorized as direct materials or direct labor. The price a business charges its customers is usually negotiated or decided based on the cost of manufacturing.

This option is best if you’re just starting out and don’t have any historical data to work with. The adjustment made to eliminate this difference at the end of the period is called the disposition of over or underapplied overhead. Predetermined Overhead Rate is the overhead rate used to calculate the Total Fixed Production Overhead. Once you have a good handle on all the costs involved, you can begin to estimate how much these costs will total in the upcoming year. Despite what business gurus say online, “overhead” and “all business costs” are not synonymous. From the above list, salaries of floor managers, factory rent, depreciation and property tax form part of manufacturing overhead.