Also called “mandatory deductions,” involuntary deductions are legally-required payroll deductions, such as payroll taxes and wage garnishments. An employer-paid federal payroll tax which is used to help fund the unemployment insurance system. Also provides a fund that states can borrow from for unemployment benefits purposes. Represents the Social Security tax and Medicare tax an employer must withhold from employees’ paychecks plus the employer’s share of those 2 taxes. The Electronic Federal Tax Payment System (EFTPS) allows employers to make federal employment tax payments electronically via the Internet or by phone.

We’ve got a glossary filled with the most common payroll terms and easy-to-understand definitions. This guide can help you create your employee handbook, which you can start building with this tool. Click on any of the letters below to jump to words that start with that letter. For more help with running your business, check out our glossaries for HR and benefits terms, too. Health Savings Account (HSA) funds can be used for qualified medical expenses and are wholly owned by the employee. Those funds are not subject to certain taxes at the time of deposit.

Joint Employer

The total income and benefits employees have earned but not yet received. Other workers are considered non-exempt and you must pay them overtime. A worker is considered non-exempt and eligible for overtime unless an exemption can be proved by the employer. Businesses with hourly employees often pay in arrears to give time for employees to submit timesheets. Compensation is an overarching term that encompasses all the types of payments an employee earns.

State Unemployment Tax Act (SUTA) taxes fund state-administered unemployment programs. SUTA is an employer-paid tax, except in Alaska, New Jersey, and Pennsylvania, where both employers and employees chip in. The Fair Labor Standards Act (FLSA) requires employers to pay employees regularly. Your pay-period options are weekly, intuit online payroll biweekly, semimonthly, or monthly.

Includes guidance on handling both employer and employee federal payroll taxes. Subtract amounts from an employee’s wages for taxes, garnishments or levies, and other deductions (like medical insurance or union dues). These amounts are paid over to the government agency or other party to whom they are owed. Overtime is the additional amounts paid to hourly employees who work over 40 hours in a week, who work on weekends, or other additional amounts. Overtime must be paid at one-and-a-half times the person’s hourly pay rate for employees who work more than 40 hours in a workweek. Most deductions don’t affect the amount of an employee’s taxable income, but some are considered pre-tax.

Even small amounts like a $100 gift card must be reported as taxable income by employees. Courts sometimes issue garnishment orders for debts like student loans, small claims judgments, child support, or other amounts the employee owes. You must comply with the order if you receive a garnishment notice ordering your business to garnish wages. Garnishment is typically done on a per-paycheck basis, so you’ll have to add this to your list of deductions.

Extended Illness Bank (EIB)

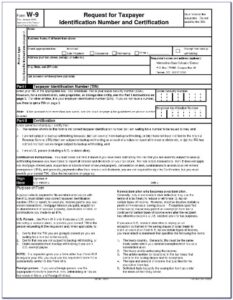

Also known as a Federal Tax Identification Number, an Employer Identification Number is a unique 9-digit number assigned to a business by the IRS. SSN stands for Social Security number, or the code assigned by the Social Security Administration to every American’s social security account. A high-deductible health plan (HDHP) is a health insurance plan that has lower premiums and higher deductibles than a typical health insurance plan.

Independent contractors are self-employed people or businesses hired to complete specific tasks and most often receive project-based compensation. Companies hire what is cash coverage ratio employees to perform services and are salaried or paid hourly. Payroll taxes are taxes levied on employers, employees, or both based on employee earnings. Most payroll taxes are calculated as a percentage of employee earnings. Each payroll tax comes with its own set of rules, exceptions, and limitations.

Independent contractor vs. employee

Income tax withholding refers to the money an employer keeps, or withholds, from an employee’s paycheck to remit for paying federal or state income taxes. Employees fill out Form W-4 and a state withholding certificate to direct their employers how much to withhold for income tax payments. The amount of federal income tax an employer is required to withhold from an employee’s wages. Federal income tax withholding is based on the employee’s Form W-4 and the IRS’ withholding tax tables.

- Updated regularly with industry-specific vocabulary and concepts, the Glossary provides easy-to-understand definitions of tax-related terms.

- Also included is any additional time the employee is allowed (i.e., suffered or permitted) to work.” Defined by the United States Department of Labor.

- The remaining amount of pay an employee receives after taxes and deductions.

- A third-party organization that partners with businesses to streamline HR and payroll tasks.

Gross pay, also called gross wages, is the total financial statement fraud amount an employee earns before payroll deductions. An employee’s wages from the start of the year to their most recent payday. Year-to-earnings are typically reflected on the employee’s pay stubs. In terms of state payroll taxes, an employee is a resident if the state is officially their home and they have no intention of living there temporarily. The portion of an employee’s wages that is subject to Medicare tax withholding. The federal employment tax reports that an employer must file periodically (e.g., quarterly and annually) with the IRS.