However, make sure that you renegotiate your interest rates to an even better rate than what you were getting earlier. If you are reporting a loss, then your Times Interest Earned ratio will be negative. https://x.com/BooksTimeInc When you have a net loss, the Times Interest Earned ratio is certainly not the best ratio to concentrate on.

Everything You Need to Master Growth Equity Interviews

In this case, lenders use the Times Interest Earned Ratio to check if the company can afford to take on additional debt. Here, we can see that Harrys’ TIE ratio increased five-fold from 2015 to 2018. This indicates that Harry’s is managing its creditworthiness well, as it is continually able to increase its profitability without taking on additional debt. If Harry’s needs to fund a major project to expand its business, it can viably consider financing it with debt rather than equity. However, a company with an excessively high TIE ratio could indicate a lack of productive investment by the company’s management.

Defining EBIT

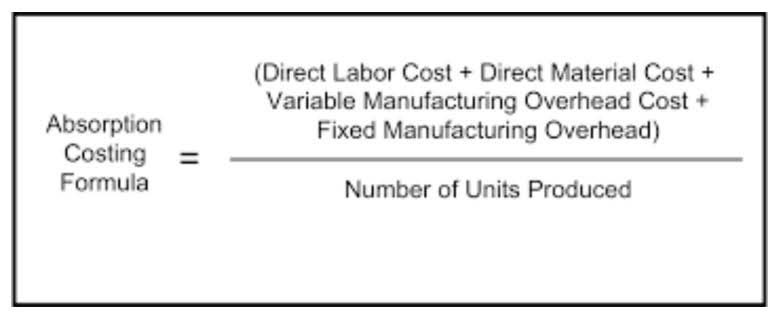

It is a measure of a company’s ability to meet its debt obligations based on its current income. The formula for a company’s TIE number is earnings before interest and taxes (EBIT) divided by the total interest payable on bonds and other debt. The result is a number that shows how many times a company could cover its interest charges with its pretax earnings.

How often should the TIE Ratio be calculated for accurate financial analysis?

Like any metric, the TIE ratio should be looked at alongside other financial indicators and margins. Here’s everything you need to know, including how to calculate the times interest earned ratio. The times interest earned ratio is also somewhat biased towards larger, more established companies in safer sectors due to credit terms and interest rates. Imagine two companies that earn the same amount of revenue and carry the same amount of debt. However, because one company is younger and is in a riskier industry, its debt may be assessed a rate twice as high.

- Companies that have a times interest earned ratio of less than 2.5 are considered a much higher risk for bankruptcy or default.

- Conversely, a TIE ratio below 1 suggests that a company cannot meet its interest obligations from its operating income alone, which is a cause for concern.

- There are so many other factors like the debt-equity ratio and the market conditions which should be used to assess before lending.

- A lower ratio signals the company is burdened by debt expenses with less capital to spend.

While it is easier said than done, you can improve the interest coverage ratio by improving your revenue. The company will be able to increase its sales which will help boost earnings before interest and taxes. However, just because a company has a high times interest earned ratio, it doesn’t necessarily mean that they are able to manage their debts effectively. If the Times Interest Earned ratio is exceptionally high, it could also mean that the business is not using the https://www.bookstime.com/articles/what-is-accountancy excess cash smartly. Instead, it is frivolously paying its debts far too quickly than necessary.

It is necessary to understand the implications of a good times interest earned ratio and what is means for the entity as a whole. Apart from this, the business also needs to ensure that there are no chances for fraud to occur. When frauds occur, it will result in a huge loss to the company, which will also affect its ability to pay off its debts. On top of this, it can seriously affect the relationship with the customers when they know about the fraud. To ensure that you are getting the real cash position of the company, you need to use EBITDA instead of earnings before interests and taxes. EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

- The times interest earned ratio (TIE) compares the operating income (EBIT) of a company relative to the amount of interest expense due on its debt obligations.

- Usually, a higher times interest earned ratio is considered to be a good thing.

- Businesses consider the cost of capital for stock and debt and use that cost to make decisions.

- But in the case of startups, and other businesses, which do not make money regularly, they usually issue stocks for capitalization.

- Now, let’s take a more detailed look at why businesses might want to consider TIE to manage finances wiser and get a more accurate picture of their financial stability.

- They will start funding their capital through debt offerings when they show that they can make money.

Turn every feedback into a growth opportunity

By downloading this guide, you are also subscribing to the weekly G2 Tea newsletter to receive marketing news and trends. Due to Hold the Mustard’s success, your family is debating a major renovation that would cost $100,000. You are required to compute Times Interest Earned Ratio post new 100% debt borrowing. We shall add sales and other income and deduct everything else except for interest expenses. If the agreement allows for it, you can change your financiers and go to a different lender.

It’s an invaluable tool in the assessment of a company’s long-term viability and creditworthiness. While a company might have more than enough revenue the times interest earned ratio provides an indication of to cover interest payments, it may be facing principal obligations coming due that it won’t be able to pay for. By analyzing TIE in conjunction with these metrics, you get a better understanding of the company’s overall financial health and debt management strategy.