Content

It means they prioritize seeking trade signals from candlestick patterns, rather than technical indicator setups. In this case, the candlestick chart takes the role of «trading indicator» by itself. The Stochastic Oscillator indicator is used for CDFC trading, as well as indices and forex. This scalping strategy indicator takes into consideration the closing price of the asset and compares it with several high and low prices of the same asset recorded over a given period of time. The SMA indicator, also known as the Simple Moving Average indicator, takes the aggregate of closing prices over a period of time. This indicator can help you identify if the price of your security or commodity is rising or falling.

The core of the technical analysis is to identify the trend… Traders utilize forex indicators as instruments for market analysis and to… The trade of 0.01 lots was in the Forex market for 30 minutes and yielded 1.72 USD. You can download the Forex scalping strategy template via this link. If the gap between the two conditions equals one candlestick, you can open a trade, but such a signal is considered as lagging.

The broker is headquartered in New Zealand which explains why it has flown under the radar for a few years but it is a great broker that is now building a global following. The BlackBull Markets site is intuitive and easy to use, making it an ideal choice for beginners. On the other hand, a sell-trade happens when the price is above the parabolic dots. The Parabolic Stop And Reversal is a trend indicator that is characterised by a series of dots above and below the price. Others sell as long as it is between the lower and middle lines of the bands.

Trading platforms

Many traders lose their hard-earned money because of unexpected price swings. Some shift to smaller time frames and turn to scalp trading to reduce the risk of exposure to significant price fluctuations. Scalping is a short-term trading style wherein traders make profits from small price changes.

- Scalpers are also exempt from following basic fundamentals because they are virtually irrelevant in shorter time frames.

- BlackBull Markets is a reliable and well-respected trading platform that provides its customers with high-quality access to a wide range of asset groups.

- Forex scalpers will typically look at shorter-term averages and one longer average to indicate a trend.

To make profits from scalping, one needs to use high leverage, which comes with high risk. But still, despite all the drawbacks of scalping trading, Forex scalping is, first of all, satisfaction and excitement. That is why most traders like the Forex scalping system so much. Volume Spread Analysis (VSA) is the in-depth analysis of small price movements based on volumes. Other lines are auxiliary, but if they start indicating a reversal and the profit has already covered the spread, exit the trade and wait until the price goes beyond the envelope next time. If the price has been between the red and the blue lines for a long time (from 8-10 candles and longer) or outside the red line, you do not enter a trade.

The 6 Best Scalping Indicators to Use Right Away!

While using this indicator traders get the signals telling them if an asset is overbought or oversold, and just like many other oscillators, it is done in the range of 0 to 100. MACD is a trend-following momentum indicator that is commonly used by Forex traders. While using this indicator, traders can receive signals about potential market reversals and act accordingly.

The Volume-Weighted Average Price (VWAP) is one of the best indicator for scalping. Indeed, because of how it is created, the VWAP indicator is only used for scalping. Yes, scalping involves short-term trading and is completely https://g-markets.net/helpful-articles/best-forex-indicators/ legal and allowed by exchanges and brokerages. Monday -50Tuesday -70Wed -20Thur -60Friday +1800Then your win rate is only 20%. In addition, you can read more about the difference between scalping and swing trading here.

Top 5 indicators for a forex scalping strategy

If you’re prone to high risk and emotionally stable, your scalping will be profitable. As theory suggests, stop loss should be placed in any circumstances, but you will lose time then. If you’re glued to the screen, there’s no need to place pending orders. If you need to leave your workplace for some time, then place stop loss. Compared with stocks or currency pairs, cryptocurrencies are more volatile and at the same time highly liquid.

- In trading terms, these bands expand when volatility picks up and contract again during periods when volatility has died down.

- It will enable traders to transform small profits into massive gains.

- In pipsing or short-term scalping Forex, trades are closed with the profit of «1-2 points + spread».

- And now, we will look at the eight most commonly used scalping indicators.

- In particular, forex scalping signals are important, due to the speed of the trade.

In contrast to classic scalping, trades can be opened for a few minutes. Binary options scalping is a suitable strategy for short-term trades that implies opening options and turbo warrants with 5-minute expiry. Binary trading is a type of trading where a trader needs to have forecast the price’s location relative to a current price level before the option expires. Scalping in stock liquid markets is high-frequency trading in stocks, futures, and other derivatives. Trades are opened for a period of time that can compensate for margin and commissions, which can go up to 50-90% of earned profits. The most volatile and liquid tools serve as assets for scalping.

I, on the contrary, believe that a beginner should train Forex scalping before dealing with middle- and long-term Forex trading strategies. Scalping helps one train attention and reaction speed; it visually shows slippage problems. A moving average is a mathematical formula used to help spot emerging and common trends in markets, represented as a single line showing an average. There are two types of moving average – simple moving average (SMA) and exponential moving average (EMA). Moving averages are popular indicators in most forex scalping strategies, as they’re easy to read. The relative strength index (RSI) is a momentum oscillator that predicts the future direction of the forex market over a period of time.

What is Scalp trading?

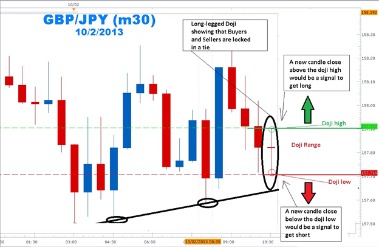

Afterward, either buy or sell orders are opened and closed in seconds- minutes. The changes in prices during this period are used to predict potential reversals. Further, the stochastic sensitivity can be adjusted by reducing or increasing the time period.

We have not established any official presence on Line messaging platform. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Bollinger Bands is another scalping indicator that was developed by combining moving averages with standard deviation. The middle line of the indicator is the moving average while the upper and lower lines are the standard deviations.

Unique identifiers (such as PAN numbers) are collected from Web Site visitors to verify the user’s identity. The stocks present in uptrends remain in uptrends, and the selling must be reserved only when you get to reach all your predetermined profit objectives. In trading terms, these bands expand when volatility picks up and contract again during periods when volatility has died down.

For example, some traders buy and hold an asset as long as it is going upwards and is between the upper and middle lines of the bands. This is different from what other day traders do, who begin from a hourly to a 30-minute and then to a 15-minute chart. Once you’re comfortable with the workflow and interaction between technical elements, feel free to adjust standard deviation higher to 4SD or lower to 2SD to account for daily changes in volatility. Better yet, superimpose the additional bands over your current chart so that you get a broader variety of signals. The stop loss should be placed just below the last swing low (for a buy trade) or above the previous swing high (for a sell trade).

You can see examples where the intertwinement of MAs was a false signal on the screenshot below. Forex Scalping trading strategy based on fundamental analysis without using indicators. A trader can open dozens of trades in various assets simultaneously, trying to exploit every small price fluctuation. Profits can go up to several points, but the total result can compare to other trading systems’ efficiency because of the large amount of trades. For example, three candlesticks yielded nearly 11 points in short positions for 4-digit quotes in the M5 chart of the EURUSD. It corresponds to 10 USD for a 0.1 lot trade with a spread of 1 point.

They identify potential trading opportunities by monitoring the slightest of changes in the stock market. Scalping is counterintuitive to many traders, and it’s because the winners get sold out pretty fast, especially more quickly than the losers. All-day traders are pretty used to going in and out of positions within a short time, but the best scalping indicator technique takes it to a whole new level. To calculate the average convergence divergence indicator, you need to subtract the 26 days EMA from the 12 days EMA.